Many major steelmakers expect challenging market conditions in the fourth quarter. Consequently, MEPS has lowered its stainless steel production forecast, for 2022, to 56.5 million tonnes. The total outturn is projected to rebound to 60 million tonnes in 2023.

Worldstainless, the body representing the global stainless steel industry, expects consumption to recover, next year. However, energy costs, developments in the war in Ukraine, and measures adopted by governments to combat inflation provide substantial risks to the forecast.

Major European stainless steel mills began reducing their output in the middle of 2022, as energy costs soared. That trend is expected to continue, in the final three months of this year. Demand from local distributors is weak.

At the onset of the war in Ukraine, supply concerns caused stockists to place large orders. Their inventories are now inflated. Moreover, end-user consumption is falling. The Eurozone purchasing managers’ indices, for the manufacturing and construction sectors, are currently below 50. The figures indicate that activity in those segments is dropping.

European producers are still contending with raised power expenditure. Attempts by regional flat product mills to introduce energy surcharges, to recoup those costs, are being rejected by local buyers. Consequently, domestic steelmakers are reducing their output to avoid unprofitable sales.

US market participants are adopting more positive economic outlooks than their counterparts in Europe. Nevertheless, underlying domestic steel demand is falling. Availability of material is good. Output in the fourth quarter is expected to decline, so that production meets the current market demand.

Asia

Chinese steelmaking is forecast to fall, in the second half of the year. Covid-19 lockdowns are supressing domestic manufacturing activity. Expectations that domestic steel consumption would increase after the Golden Week holidays proved to be unfounded. Furthermore, despite recently announced fiscal measures to support the Chinese property sector, underlying demand is weak. As a result, melting activity is forecast to decline, in the fourth quarter.

In South Korea, the estimated melting figures for the July/September period fell, quarter-on quarter, due to weather-related damage to POSCO’s steelmaking plants. Despite plans to rapidly bring those facilities back online, South Korean production is unlikely to recover significantly, in the final three months of this year.

Taiwanese melting activity is being weighed down by high domestic stockholder inventories and poor end-user demand. In contrast, Japanese output is expected to remain relatively stable. Mills in that country are reporting steady consumption by local customers and are likely to maintain their current output.

Indonesian steelmaking is estimated to have slipped in the July/September period, quarter-on-quarter. Market participants report shortages of nickel pig iron – a key raw material for stainless steel production in that country. Furthermore, demand in Southeast Asia is muted.

Source: MEPS International

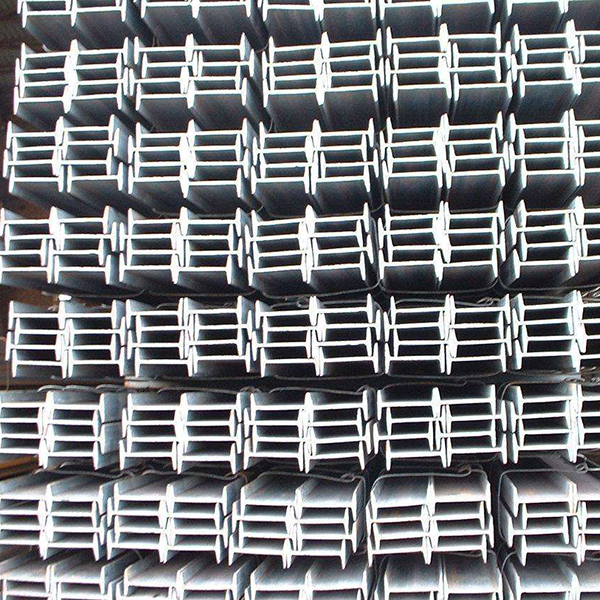

(Steel pipe,Steel bar,Steel sheet)

https://www.sinoriseind.com/copy-copy-erw-square-and-rectangular-steel-tube.html

https://www.sinoriseind.com/i-beam.html

Post time: Dec-01-2022